Direct-to-Consumers – Is it the New Business Insurance Policy?

Just when the retail market was on pace to reach nearly $27 trillion in annual sales – the coronavirus had another plan.

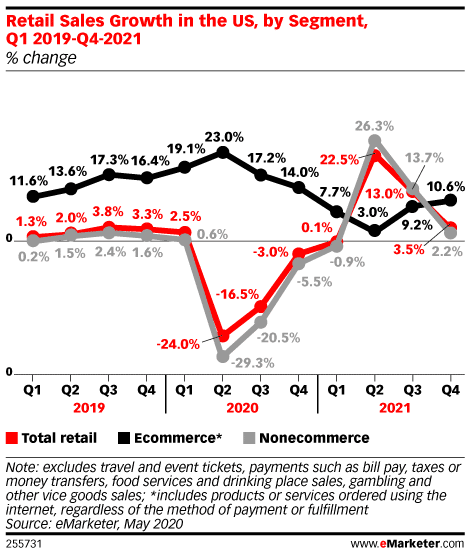

Revenues in the second quarter alone saw dramatic decreases of up to 30% for non-e-commerce retailers, while e-commerce brands saw a healthy 23% increase in sales.

And as the mad scramble to pivot to online offerings ensued, the retail industry reported over $3 trillion in lost revenue, making it immediately clear which health brands positioned themselves to survive and which were forced to close their doors forever.

That’s why now more than ever…

Direct-to-Consumers Health Brands

E-commerce is the secret to “revenue-proofing” your health brand

Because while mega health retailers and fitness chains like GNC, 24 Hour Fitness, and Gold’s Gym have filed for bankruptcy. Other health brands like Peloton, Echelon Vitacost, and Whole Foods saw record gains through the pandemic.

What was their secret to insulating and expanding their sales?

Online shopping options

By the end of March 2020, more than 35% of consumers were shopping more online for their health and wellness needs, markedly up from previous year-over-year estimates. In fact, recent research released from Pew estimates that nearly 52% of all American adults participated in an online home fitness class in April alone.

Direct-to-Consumers Marketing

E-commerce is no longer just another distribution channel

It, instead, is now THE best way to stay connected with consumers. Prevent a loss of sales if and when, this pandemic draws on. With millions of consumers forced to stay at home and traditional brick and mortar channels being limited or no longer accessible. Consumers have no choice but to look online to fill their health and wellness needs.

And, the crisis-oriented consumer wants easy access to the products they trust. And they want to get them straight from the door. That’s why offering a seamless online shopping experience and reliable delivery options are one of the most effective ways. It helps to capitalize on this new crisis-oriented consumer behavior.

This new trend in “click-and-collect” consumerism is expected to continue to surge, even as stores reopen. Those health brands that can expand their e-commerce options won’t just maximize their revenues in the short term. But they can carve out measurable market share as consumer preferences shift to prefer on-demand, hyper convenient shopping alternatives.

Based on the continued surge in online shopping that is expected to continue well into 2021, with consumers still limiting their in-person shopping, economists now expect that e-commerce sales will be up $58.52 billion – nearly a 60% increase from original estimates.

Pivot now and look for ways to rapidly expand your e-commerce options or take your chances with the uncertainty. It lies ahead and risk losing your health brand.

You decide.

Learn How to Market Your Health and Wellness Offerings in 2020